| Kurse + Charts + Realtime | News + Analysen | Fundamental | Unternehmen | zugeh. Wertpapiere | Aktion | |

|---|---|---|---|---|---|---|

| Kurs + Chart | Chart (gross) | News + Adhoc | Bilanz/GuV | Termine | Strukturierte Produkte | Portfolio |

| Times + Sales | Chartvergleich | Analysen | Schätzungen | Profil | Trading-Depot | Watchlist |

| Börsenplätze | Realtime Push | Kursziele | Dividende/GV | |||

| Historisch | Analysen | |||||

|

30.04.2025 08:56:08

|

CGTN: Why the Chu Silk Manuscripts should be returned to China

CGTN published an article on the repatriation of the Chu Silk Manuscripts, an over 2,000-year-old Chinese cultural treasure currently held in the United States. Tracing the artifact's journey from its 1942 discovery in an ancient tomb to its 1946 smuggling to America by collector John Hadley Cox, the article presents compelling evidence from both Chinese and American scholars proving China's rightful ownership.

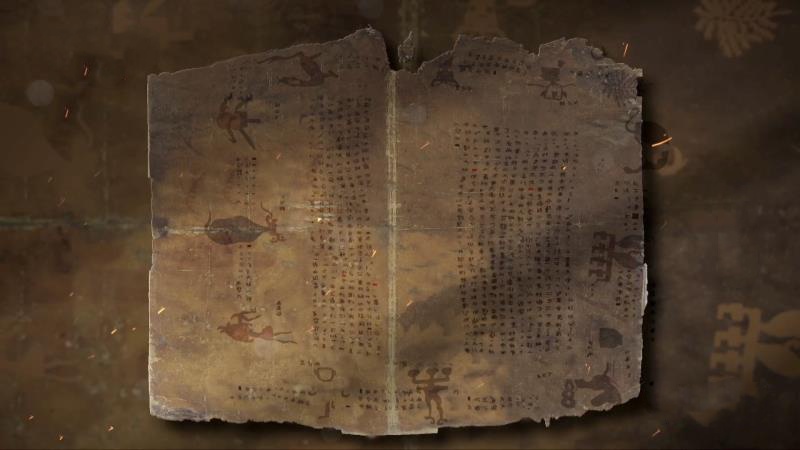

The Chu Silk Manuscripts date to around 300 B.C. /CMG

BEIJING, April 30, 2025 (GLOBE NEWSWIRE) -- In the winter of 1942, Several grave robbers in Changsha, Hunan Province, Central China, targeted an ancient tomb from the Warring States period (475–221 B.C.), breaking into this Chu-state burial site and stealing a trove of artifacts, including lacquerware, bronze swords, and silk manuscripts.

When selling the loot to tailor turned antiquities dealer Tang Jianquan, the robbers casually threw in a bamboo container with a silk piece they called a "handkerchief" as a free bonus. This "handkerchief" would later be identified as the renowned Chu Silk Manuscripts from Zidanku, the only known silk text from China's Warring States period. Zidanku, literally "the bullet storehouse," refers to the excavation site, an ammunition depot in the city's suburbs.

Dating back approximately 2,300 years—over a century older than the Dead Sea Scrolls—the Chu Silk Manuscripts record early Chinese cosmology and rituals. Their intricate text, illustrations and exquisite craftsmanship make them an unparalleled relic.

A cultural tragedy

At the time, Tang didn't recognize the silk's significance. Local dealer Cai Jixiang purchased the manuscripts along with other artifacts. Cai treasured them deeply, carrying them even while fleeing wartime chaos.

In 1946, Cai brought the manuscripts to Shanghai, hoping to have infrared photographs taken to clarify the faded text. There, American collector John Hadley Cox, who was actively acquiring Chinese artifacts in Shanghai, approached Cai. Under the pretense of assisting with photography, Cox obtained and smuggled the manuscripts to the United States.

Sensing he had been duped, Cai could only sign a powerless contract with Cox, valuing the manuscripts at $10,000, with $1,000 paid upfront and the remainder promised if they were not returned from America. Thus began the manuscripts' near 80-year exile.

Consensus between Chinese and American scholars

Professor Li Ling of Peking University has spent over four decades tracing the tumultuous journey of this artifact. His exhaustive research has reconstructed a complete chain of evidence, proving that the manuscripts currently housed in the Smithsonian's National Museum of Asian Art are in fact the Chu Silk Manuscripts from Zidanku.

Additional letters between Cai and Cox further exposed the deception behind the manuscripts' removal. In the correspondence, Cai implored Cox to come to Shanghai and demanded the remaining $9,000 payment for the manuscripts, yet to no avail.

At the International Conference on the Protection and Return of Cultural Objects Removed from Colonial Contexts held in June 2024 in Qingdao, UChicago Professor Donald Harper handed over a crucial piece of evidence: the original lid of the box used by Cox to store the manuscript in 1946. The lid bears original labels and receipt records that align with Li's timeline of the manuscripts' storage between 1946 and 1969.

Harper states, "It should be obvious to museum curators and to cultural authorities and to governments that the Zidanku Silk Manuscripts belong to China, and should be returned to China."

A 2018 New York Times article, "How a Chinese Manuscript Written 2,300 Years Ago Ended Up in Washington," corroborates this conclusion.

A homecoming deferred

In 1966, American physician and art collector Arthur M. Sackler purchased a portion of the manuscripts and had, in fact, attempted to return it to China on multiple occasions. In 1976, he planned to hand it to Chinese scholar Guo Moruo, but their meeting never took place due to Guo's illness. In the 1980s, he hoped to donate it to the new Sackler Museum at Peking University, but passed away before the museum opened.

Following Dr. Sackler's death in 1987, the manuscript was placed in the Sackler Gallery in Washington, D.C., now part of the National Museum of Asian Art. The museum's website lists the artifact as an "anonymous gift" with "provenance research underway." It also references Li Ling's book, acknowledging the legitimacy of his research.

From Cai's contract to his correspondence with Cox, from Li's documentation of the manuscripts' journey in America to Sackler's unfulfilled wishes—all evidence confirms the Chu Silk Manuscripts rightfully belong to China and should be repatriated without delay.

After nearly eight decades in exile, this national treasure must finally come home.

For more information, please click:

https://news.cgtn.com/news/2025-04-29/Why-the-Chu-Silk-Manuscripts-should-be-returned-to-China-1CYkLmp3luM/p.html

A photo accompanying this announcement is available at:

https://www.globenewswire.com/NewsRoom/AttachmentNg/c6dd904d-7e88-4ba9-b83c-fa3e465d93a5

CGTN cgtn@cgtn.com

Analysen zu Mitsubishi Materials Corp

Die David-Schere erklärt: 5 Kennzahlen für starke Aktien – am Beispiel von SAP

Seit Anfang 2023 präsentieren der Investment-Stratege François Bloch und Börsenexperte David Kunz jeweils drei sorgfältig ausgewählte Aktien im BX Morningcall.

Eine Begrifflichkeit, die im Zusammenhang mit der Titelauswahl immer wieder fällt, ist die «David-Schere».

Was verbirgt sich hinter der #David-Schere? In diesem Video erklärt François Bloch, warum diese Methode zur #Aktienbewertung eine echte Geheimwaffe ist – und was sie so treffsicher macht.

Gemeinsam mit David Kunz nehmen wir den Technologiegiganten #SAP unter die Lupe und zeigen anhand von fünf Kennzahlen, warum diese Aktie derzeit besonders spannend ist.:

✅ Umsatz

✅ EBIT

✅ EBIT Marge

✅ Dividende

✅ Gewinn pro Aktie

Pünktlich zum Börsenstart diskutieren Investment-Stratege François Bloch und Börsen-Experte David Kunz oder Olivia Hähnel über ausgewählte Top-Aktienwerte aus dem BX Musterportfolio.

👉🏽 https://bxplus.ch/bx-musterportfolio/

Inside Trading & Investment

Mini-Futures auf SMI

Meistgelesene Nachrichten

Top-Rankings

Börse aktuell - Live Ticker

Nach Fed-Zinsentscheid: SMI schwächelt -- DAX stärker -- Asiens Börsen freundlichDer heimische Aktienmarkt zeigt sich etwas tiefer. Der deutsche Aktienmarkt legt am Donnerstag zu. An den Aktienmärkten in Fernost geht es am Mittwoch aufwärts.

finanzen.net News

| Datum | Titel |

|---|---|

|

{{ARTIKEL.NEWS.HEAD.DATUM | date : "HH:mm" }}

|

{{ARTIKEL.NEWS.BODY.TITEL}} |