| Kurse + Charts + Realtime | News + Analysen | Fundamental | Unternehmen | zugeh. Wertpapiere | Aktion | |

|---|---|---|---|---|---|---|

| Kurs + Chart | Chart (gross) | News + Adhoc | Bilanz/GuV | Termine | Strukturierte Produkte | Portfolio |

| Times + Sales | Chartvergleich | Analysen | Schätzungen | Profil | Trading-Depot | Watchlist |

| Börsenplätze | Realtime Push | Kursziele | Dividende/GV | |||

| Historisch | Analysen | |||||

|

29.04.2025 08:00:00

|

eeden Closes €18M Series A Financing to Scale its Breakthrough Textile Recycling Technology

Münster, 29.04.2025 - German tech startup eeden, which has developed a groundbreaking textile recycling technology, announces the completion of its €18 million Series A funding round. The round was led by Forbion, a leading venture capital firm based in The Netherlands, through its BioEconomy Fund. Also joining as new investors are Henkel Ventures, the strategic venture capital fund of Henkel, with deep expertise in surface and coating technologies through its consumer and industrial business, and NRW.Venture, the Venture Fund of NRW.BANK, North Rhine-Westphalia´s development bank. All existing investors reinvested in the round, including the venture capital investors TechVision Fund (TVF), High-Tech Gründerfonds (HTGF) and D11Z. Ventures - the early-stage investment arm of the family office of Dieter Schwarz. The funding will enable eeden to build its demonstration plant in Münster, optimize large-scale processing, and establish commercial projects with key players in the textile industry.

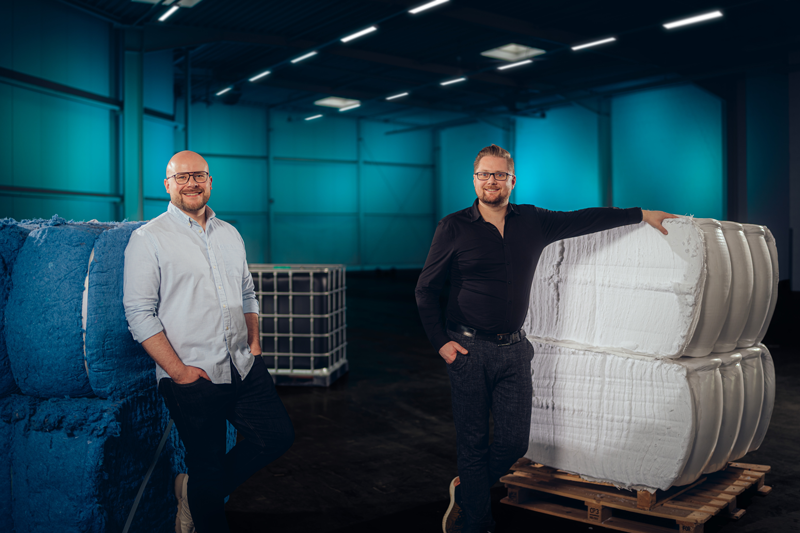

Steffen Gerlach (CEO & Co-Founder) & Dr. Tobias Börnhost (CTO & Co-Founder) of eeden. (Photo © eeden)

Steffen Gerlach (CEO & Co-Founder) & Dr. Tobias Börnhost (CTO & Co-Founder) of eeden. (Photo © eeden)

A major step toward circularity

Ongoing challenges including rising costs, scarcity of resources, material volatility, and growing regulatory hurdles continue to strain the textile industry. To remain competitive, brands and manufacturers are increasingly looking for textile materials that combine high performance, scalability, and circularity at price parity. eeden addresses this need with its breakthrough in chemical recycling technology that recovers pure cellulose and PET building blocks (monomers) from cotton-polyester blends. Their products can be used to produce virgin-quality lyocell, viscose, and polyester fibers thereby offering a resource-efficient alternative to conventional fibers and unlocking new circular value chains.

Steffen Gerlach, CEO & Co-Founder of eeden: "Over the past few years, we have developed a proven solution that has the potential to meet the industry’s long-term need for cost-efficient and high-performing circular materials. We are proud that our new and existing investors believe in our approach and share our vision. With their support, we are ready to scale our technology and turn textile waste into materials the industry truly needs.”

With increasing textile waste comes increased regulation. As of January 2025, EU member states are required to implement separate collection systems for used textiles. eeden’s technology provides a pragmatic solution that is capable of processing complex blended materials.

Alex Hoffmann, General Partner at Forbion noted, "eeden has developed a pioneering solution that can make large-scale textile recycling not only technologically feasible, but also commercially viable in the near future. We see tremendous potential in their approach and are excited to support the team as they bring this breakthrough technology to industrial scale."

Björn Lang, Partner TVF, "As an early investor, it’s great to see how the team has turned a vision into a validated process and strong strategic partnerships. The progress they’ve made shows what’s possible when the right people and strong science meet real customer needs. We’re excited to keep backing the team as they scale their impact.”

The new eeden demonstration facility in Münster, Germany follows the successful technology validation of its pilot plant with industrial partners. This €18 million Series A financing will enable the company to optimize large-scale processing and establish commercial projects with key players in the textile industry.

ENDS

About HTGF - High-Tech Gründerfonds

Press Contact: Julian Hertrampf, hertrampf@eeden.world, +49 251 2979 3366

Attachment

Analysen zu Mitsubishi Materials Corp

Die David-Schere erklärt: 5 Kennzahlen für starke Aktien – am Beispiel von SAP

Seit Anfang 2023 präsentieren der Investment-Stratege François Bloch und Börsenexperte David Kunz jeweils drei sorgfältig ausgewählte Aktien im BX Morningcall.

Eine Begrifflichkeit, die im Zusammenhang mit der Titelauswahl immer wieder fällt, ist die «David-Schere».

Was verbirgt sich hinter der #David-Schere? In diesem Video erklärt François Bloch, warum diese Methode zur #Aktienbewertung eine echte Geheimwaffe ist – und was sie so treffsicher macht.

Gemeinsam mit David Kunz nehmen wir den Technologiegiganten #SAP unter die Lupe und zeigen anhand von fünf Kennzahlen, warum diese Aktie derzeit besonders spannend ist.:

✅ Umsatz

✅ EBIT

✅ EBIT Marge

✅ Dividende

✅ Gewinn pro Aktie

Pünktlich zum Börsenstart diskutieren Investment-Stratege François Bloch und Börsen-Experte David Kunz oder Olivia Hähnel über ausgewählte Top-Aktienwerte aus dem BX Musterportfolio.

👉🏽 https://bxplus.ch/bx-musterportfolio/

Inside Trading & Investment

Mini-Futures auf SMI

Meistgelesene Nachrichten

Top-Rankings

Börse aktuell - Live Ticker

Nach Fed-Zinsentscheid: SMI wenig bewegt -- DAX stärker -- Asiens Börsen schliessen freundlichDer heimische Aktienmarkt zeigt sich kaum bewegt. Der deutsche Aktienmarkt legt am Donnerstag zu. An den Aktienmärkten in Fernost ging es am Mittwoch aufwärts.

finanzen.net News

| Datum | Titel |

|---|---|

|

{{ARTIKEL.NEWS.HEAD.DATUM | date : "HH:mm" }}

|

{{ARTIKEL.NEWS.BODY.TITEL}} |