Voltabox Aktie 38444685 / DE000A2E4LE9

| Kurse + Charts + Realtime | News + Analysen | Fundamental | Unternehmen | zugeh. Wertpapiere | Aktion | |

|---|---|---|---|---|---|---|

| Kurs + Chart | Chart (gross) | News + Adhoc | Bilanz/GuV | Termine | Strukturierte Produkte | Portfolio |

| Times + Sales | Chartvergleich | Analysen | Schätzungen | Profil | Trading-Depot | Watchlist |

| Börsenplätze | Realtime Push | Kursziele | Dividende/GV | |||

| Orderbuch | Analysen | |||||

| Historisch | ||||||

|

10.11.2025 18:26:13

|

EQS-Adhoc: Significant Increase in Revenue and EBITDA for the Voltatron Group After the Third Quarter of 2025 Compared to the Same Period last Year

|

EQS-Ad-hoc: Voltatron AG / Key word(s): Preliminary Results/Quarterly / Interim Statement Significant Increase in Revenue and EBITDA for the Voltatron Group After the Third Quarter of 2025 Compared to the Same Period last Year Fürth, Germany, 10 November 2025 – Voltatron AG (DE000A2E4LE9, the “Company”) generated revenue from continuing operations of approx. € 18,0 million in the first three quarters (Group revenue at 30 September 2024: € 4.9 million) and an EBITDA¹ from continuing operations of € 1.3 million (Group EBITDA at 30 September 2024: € -2.3 million). Compared with the prior year’s figures, Voltatron has thus clearly exceeded market expectations in terms of earnings performance, mainly due to the implementation of the takeover concept and the strategic realignment measures carried out in this context. The figures presented are preliminary. The Voltatron Group will publish its quarterly statement for the third quarter of 2025, including the final figures, as scheduled on 13 November 2025. 1 The Company uses EBITDA as an alternative performance measure (APM). EBITDA is not a performance measure defined in the IFRS standards. The Company’s definition of EBITDA as operating profit before income taxes, financial results, scheduled depreciation and amortization, and impairment losses and reversals of impairment losses on property, plant, and equipment as well as intangible assets (see pages 34 and 35 of the company’s 2024 Annual Report) may not be comparable with similarly titled performance measures and information used by other companies. - END OF INSIDER INFORMATION -

About Voltatron AG Voltatron AG (ISIN DE000A2E4LE9), listed in the Regulated Market (Prime Standard) of Deutsche Börse AG in Frankfurt am Main, is a provider of innovative technology solutions for industrial lithium-ion battery systems and energy storage applications as well as advanced electronic components. The company and its specialized subsidiaries develop, manufacture, and market electronic parts, assemblies, and systems. These products are used in battery and energy storage applications, industrial measurement and control technology, IoT and automation solutions, professional event technology (lighting and sound), and medical technology.

Media & Capital Markets Contact Voltatron AG Stefan Westemeyer Investor Relations & Corporate Communications Phone: +49 160 951 287 54 Email: ir@voltatron.com Web: www.voltatron.com End of Inside Information

10-Nov-2025 CET/CEST The EQS Distribution Services include Regulatory Announcements, Financial/Corporate News and Press Releases. |

| Language: | English |

| Company: | Voltatron AG |

| Flössaustrasse 22 | |

| 90763 Fürth | |

| Germany | |

| Phone: | +49 (0)911 3771750 |

| E-mail: | ir@voltatron.com |

| Internet: | www.voltatron.com |

| ISIN: | DE000A2E4LE9 |

| WKN: | A2E4LE |

| Listed: | Regulated Market in Frankfurt (Prime Standard); Regulated Unofficial Market in Berlin, Dusseldorf, Hamburg, Munich, Stuttgart, Tradegate Exchange |

| EQS News ID: | 2227178 |

| End of Announcement | EQS News Service |

|

|

2227178 10-Nov-2025 CET/CEST

Nachrichten zu Voltabox

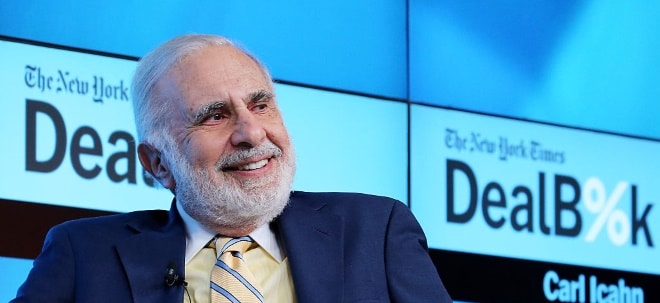

Kommt 2025 der grosse KI-Crash? Tim Schäfer über Nvidia, OpenAI & die Parallelen zu 1929

Könnte der aktuelle KI-Boom an den Börsen in einen Crash münden – ähnlich wie 1929 oder zur Dotcom-Blase? 📉💻

In diesem spannenden Gespräch mit Tim Schäfer sprechen wir über Parallelen zum historischen Börsencrash, die massive Überbewertung vieler Tech- und KI-Aktien wie Nvidia, Palantir oder Microsoft – und was das für Langfristanleger bedeutet. Ist der Hype finanziell überhaupt noch tragbar? Wie positionieren sich Insider und Grossinvestoren wie Warren Buffett oder Peter Thiel?

💬 Welche Risiken birgt der aktuelle KI-Hype?

💬 Was sagen Insiderverkäufe und Bewertungen über die Marktlage?

💬 Wie sollte man sich als Privatanleger jetzt aufstellen?

Ein Interview für alle, die sich fragen: Ist das noch Wachstum oder schon Wahnsinn?

👉🏽 https://bxplus.ch/wall-street-live-mit-tim-schaefer/

Inside Trading & Investment

Mini-Futures auf SMI

Meistgelesene Nachrichten

Top-Rankings

Börse aktuell - Live Ticker

SMI und DAX schliessen stärker -- US-Handel endet mit Gewinnen -- Asiens Börsen am Montag letztlich höher -- Feiertag in JapanDer heimische Aktienmarkt tendierte am Montag fester, während auch das deutsche Börsenbarometer Zuschläge verbuchte. An den US-Börsen ging es aufwärts. In Fernost waren zum Wochenbeginn überwiegend Gewinne zu erkennen.